April 27, 2021 by Siobhan Climer

This article was originally published in November of 2019.

According to recent research reported by CIO.com, nearly half of midmarket CIOs (Chief Information Officers) and IT executives report to the CEO, while 23% report to the CFO (Chief Financial Officer). Digital transformations have swept industries, which is one cause for the shift toward a direct line to the top.

Today’s IT leaders are less likely to engage in traditional infrastructure management; instead, IT leaders are tasked with building complex strategies, delivering ROI to the business through innovation and cybersecurity, and leveraging relationships with stakeholders to identify the best partner relationships.

By joining CFO and CIO forces, this team can derisk the business, specifically around cybersecurity, backup and disaster recovery, and growth.

Digital Transformations Drive Organization’s Structure

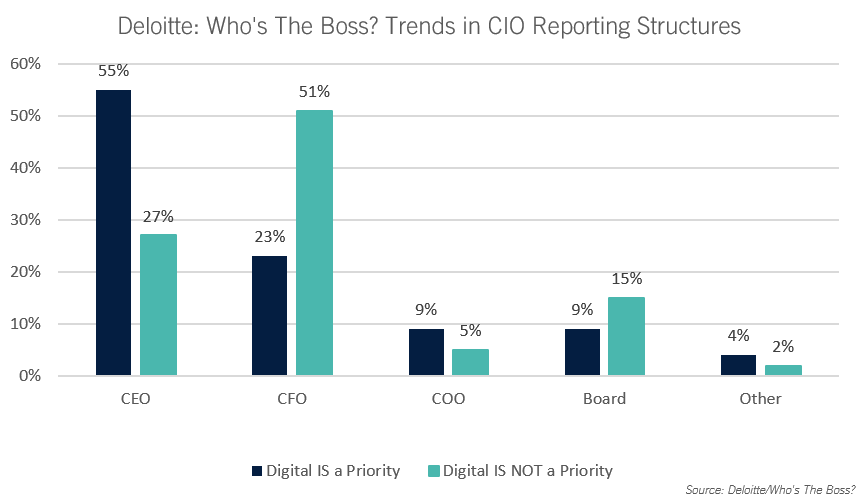

This shift in reporting structure is most prevalent in organizations where digital transformation is a priority. According to Deloitte’s Who’s The Boss? Trends in CIO Reporting Structure report, in organizations where digital is a priority, 55% of IT leaders report to the CEO. In organizations where digital is not a priority, that number drops to only 27%.

The numbers are mirrored in CFO reporting. In organizations where digital is a priority, only 23% of IT leaders report to the CFO. That number climbs to 51% in organizations where digital is not a priority.

Figure 1: Reporting Lines for Digital Leaders Versus Digital Supporters

Why And How Can The CFO and CIO Work Together?

The why is simple: the CFO holds substantial influence within the organization. The CFO holds the reins that interrelate revenue and operations, and the CIO can drive that revenue by simplifying operations and creating more efficient processes. What’s more, risk mitigation is key to the operations of the business, and thereby falls under the CFO’s purview. Yet it is the CIO, by virtue of the digital transformation, the supports risk mitigation through technology.

The why is simple: the CFO holds substantial influence within the organization. The CFO holds the reins that interrelate revenue and operations, and the CIO can drive that revenue by simplifying operations and creating more efficient processes. What’s more, risk mitigation is key to the operations of the business, and thereby falls under the CFO’s purview. Yet it is the CIO, by virtue of the digital transformation, the supports risk mitigation through technology.

When strategically aligned, the CFO and CIO are an unstoppable team.

How the CFO and CIO work together, though, is a harder question. For far too long, IT departments have been viewed as cost centers. This has, historically, put the CFO and CIO at odds with one another. The CFO seeks to manage risk, reduce overhead, and build profits. If IT is a cost center, they inevitably come into conflict with these goals.

Of course, technology is long past the era of being, by definition, a cost center (though there are many IT departments where this may still be the case). With a strategic IT leader at its helm, the IT department can be a revenue generator. Then, for all the reasons described above – risk mitigation, business growth, operational efficiency – the CFO and CIO are on the same team.

How do you build that cohesive alignment?

3 Steps To CFO And CIO Alignment

1. Collaborate. It may sound obvious, but the first step towards ensuring the CFO and CIO are strategically aligned is to align strategy…together. By keeping open lines of communication that are frequently tapped, the CFO and CIO can work on specific initiatives in sync with one another.

2. Strategize. A powerful digital transformation relies on a thoughtful strategy. Throwing on new technologies – or removing them – requires objective-based roadmaps that align technology to broader business objectives.

3. Derisk Through DR. The CFO is responsible for the allocation of resources, and IT can strategically utilize those resources to derisk the business. That is why disaster recovery (DR) programs become a central shared goal for both the CFO and CIO. By ensuring the appropriation of resources towards backups and disaster recovery programming, the CFO and CIO team can work together to derisk the business.

Disaster Recovery: Top Of Mind For CFO And CIO

Risk mitigation is a central facet of both the CFO and CIO roles. While the CIO tends to focus on security-related risks, such as ransomware or cybercriminals, the CFO is focused on broader risks, like downtime and customer relationships.

Risk mitigation is a central facet of both the CFO and CIO roles. While the CIO tends to focus on security-related risks, such as ransomware or cybercriminals, the CFO is focused on broader risks, like downtime and customer relationships.

This is why disaster recovery programming is key to meeting both the CFO and CIO objectives. There are numerous risks to not having a disaster recovery solution in place, and these risks directly impact the CFO.

Consider, for example, a business that experiences a disruptive event that features a half-day of downtime. What is the impact of that specific event? What is the impact on revenue? What is the impact on suppliers, partners, and/or customers?

The CFO is responsible for assessing and mitigating these risks. Disaster recovery solutions directly reduce the impact of a disaster event, thereby providing direct ROI – if a disaster event occurs – to the CFO.

Business Should Lead The DR Conversation

Many times disaster recovery strategy is determined by what technology is available, not the other way around. The most effective disaster recovery plans start with a business impact analysis. This analysis is looks at key components such as applications, users, physical assets, and how often backed-up data changes, and sets clear expectations on when and how much data needs to be recovered to sustain the least amount of damage. This is where it is crucial for the CFO and CIO to work together to determine what needs to be done (CFO) and how to must be done (CIO).

When testing your DR strategy, it is crucial for the CFO to also be involved in analyzing the results to determine if a greater financial investment needs to be made to the DR initiative. It is important to note that DR isn’t an IT expense, but a shared expense.

Derisk With A Strategic Technology Partner

There’s no way an IT executive can do it all. The digital transformation that pulled IT leaders away from traditional technology management and towards strategic initiatives is the same one that introduced the complexity that makes management challenging.

Mindsight holds the keys to the expertise IT leaders need. With an expert-level-only team at your fingertips, imagine what you can accomplish. As a partner, we bring expertise in cybersecurity, cloud, infrastructure, and unified communications’ solutions to you, and we can help you align your strategy to the goals of the CFO and business.

Learn More About Disaster Recovery

Join Mindsight on May 18, 2021 at 11AM CST for our virtual event, Data Protection in 2021: Reducing Your Exposure. Our CIO, Tad Gralewski will discuss how to get a customized plan in place and how organizations can cost effectively leverage shared resources.

About Mindsight

Mindsight, a Chicago IT services provider, is an extension of your team. Our culture is built on transparency and trust, and our team is made up of extraordinary people – the kinds of people you would hire. We have one of the largest expert-level engineering teams delivering the full spectrum of IT services and solutions, from cloud to infrastructure, collaboration to contact center. Our customers rely on our thought leadership, responsiveness, and dedication to solving their toughest technology challenges.

Contact us at GoMindsight.com.

About The Author

Siobhan Climer, Science and Technology Writer for Mindsight, writes about technology trends in education, healthcare, and business. She writes extensively about cybersecurity, disaster recovery, cloud services, backups, data storage, network infrastructure, and the contact center. When she’s not writing tech, she’s reading and writing fantasy, gardening, and exploring the world with her twin daughters. Find her on twitter @techtalksio.