February 22, 2022

In a fluid and tech-driven world where nearly everyone in every job must evolve to keep pace with the times or risk obsolescence, chief financial officers are no exception. Instead of miserly number crunchers, as they were long viewed, the most effective CFOs now play an integral role in nearly every aspect of the business(es) they serve.

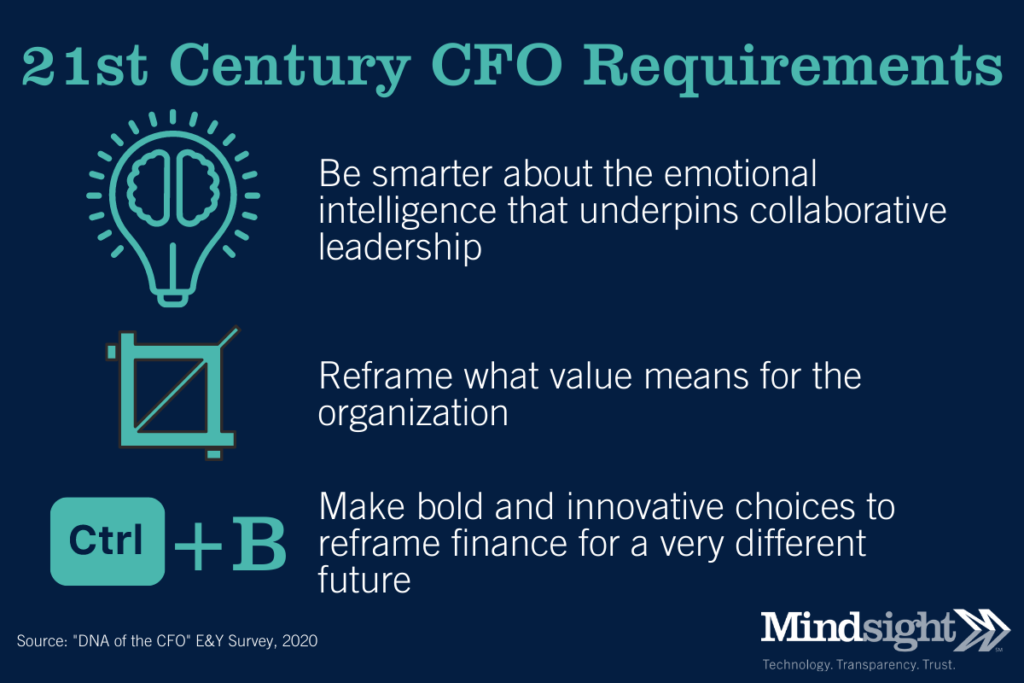

But it’s not a simple transition. According to EY’s 2020 “DNA of the CFO” Survey, being a CFO in the 21st century requires at least a few substantial adjustments:

1) Be smarter about the emotional intelligence that underpins collaborative leadership

2) Reframe what value means for the organization

3) Make bold and innovative choices to reframe finance for a very different future.

Those bold and innovative choices include, but certainly aren’t limited to, all things technological. As McKinsey has reported, between 2016 and 2021, “the share of finance leaders who say they are responsible for their companies’ digital activities has more than tripled.” Additionally, the same report noted, the number of CFOs whose companies employ robotics and AI has doubled in the last three years, and “nearly 6 in ten report either a positive or very positive ROI from [tech] investments made in the past year.”

“Technology will play an increasingly important role for the CFO, but its effectiveness depends on the accuracy, availability, and consistency of data, and on robust, integrated technology infrastructure,” international CFO and consultant Paul Ainsworth wrote last year. “Many companies are still struggling to put these foundations in place. To succeed, CFOs will have to be champions and stewards of digital technology. CFOs must adapt to new technology and be at the forefront of ERP implementations and cloud-based solutions.”

C-Level Collaboration in IT

CFOs, however, can do none of that — and little of anything else — on their own. In order to implement necessary changes and improvements, it’s vital to develop a close working relationship with other members of the C-suite, including the CEO, CTO and CIO. Their buy-in for various investments is essential, yes, but so are their insights. A shared vision and broader comprehension of a company’s overall value chain is the name of the game.

For the CFO, as a recent article from the advisory and accounting firm Clark Schaefer Hackett explained, “This means working with human resources to help drive the talent agenda; working with IT to drive technology transformation throughout the organization; working with operations to optimize efficiency in the supply chain, logistics, production and procurement functions; and working with sales and marketing to enhance visibility and target customers. While the CEO remains the visionary leader of the company, the modern CFO helps pull all the different pieces together.”

How The CFO And CIO Work Together To Derisk The Business: A Disaster Recovery Report

Post-pandemic, McKinsey’s latest Global Survey revealed, CFOs have also been forced to shift their focus away from long-term goals and onto short-term crisis management. “But the results also point to a way forward for CFOs and their companies, as more industries and economies move toward recovery — suggesting the degree to which finance leaders can have more impact in key areas of the business, and how companies can take advantage of missed opportunities to leverage the CFO’s insights and leadership.”

Tech Savvy CFOs

Here’s the thing: as tech-savvy as they might be, CFOs still need considerable help from specialists who are bonafide experts in their fields — particularly during the ongoing pandemic. Which is why it’s so important that they foster good working relationships with CIOs. “A strong strategic partnership between the CIO and CFO has been critical during the COVID-19 pandemic, especially as many companies have had to scale back on expenses and rethink their digital capabilities,” Greg Douglass, global lead of technology strategy and advisory at Accenture, told CIO.com. “As data has become increasingly important to manage and analyze for businesses to succeed, CFOs depend on CIOs to help translate the data and insights into actionable initiatives, driving optimal results for the business.”

“While the pandemic has come at a huge humanitarian and economic cost, it has also changed how we think about the world,” EY concluded in its 2020 CFO survey. “As well as protecting their people and their communities, innovative and bold companies are also pioneering new business models, accelerating digital priorities and transforming how they work. Therefore, CFOs should not just focus on the ‘here and now’ as they help lead their business through the COVID-19 pandemic. They should look to the future – not just what’s next, but beyond.”

Mindsight partners with CFOs and CIOs in helping manage day-to-day IT operations, allowing IT teams to focus on technology strategies that enable growth. Mindsight experts help ensure that technology is running optimally, regularly performing upgrades, patching and maintenance to protect systems and the business against cyber threats and downtime. Mindsight’s managed IT services help clients access a breadth of technology expertise, reduce costs, and minimize risk.

About Mindsight

Mindsight is industry recognized for delivering secure IT solutions and thought leadership that address your infrastructure and communications needs. Our engineers are expert level only – and they’re known as the most respected and valued engineering team based in Chicago, serving emerging to enterprise organizations around the globe. That’s why clients trust Mindsight as an extension of their IT team.

Visit us at http://www.gomindsight.com.